About the Client

A mid-sized real estate lending and investment firm managing multiple commercial properties and loan portfolios. The client sought a modern, data-driven way to monitor loan covenant compliance—especially the Debt Service Coverage Ratio (DSCR)—without relying on manual document reviews and spreadsheet calculations.

Challenges Faced

- ● Disconnected loan and financial documents stored in various folders and formats

- ● Manual extraction of key metrics like Net Operating Income (NOI) and Debt Service, leading to inefficiencies and delays

- ● Lack of real-time visibility into property performance or covenant breaches

- ● Repetitive compliance reporting cycles that consumed analyst bandwidth

- ● No centralized dashboard for portfolio-wide monitoring or audit trails

Our Work & Impact

How We Helped

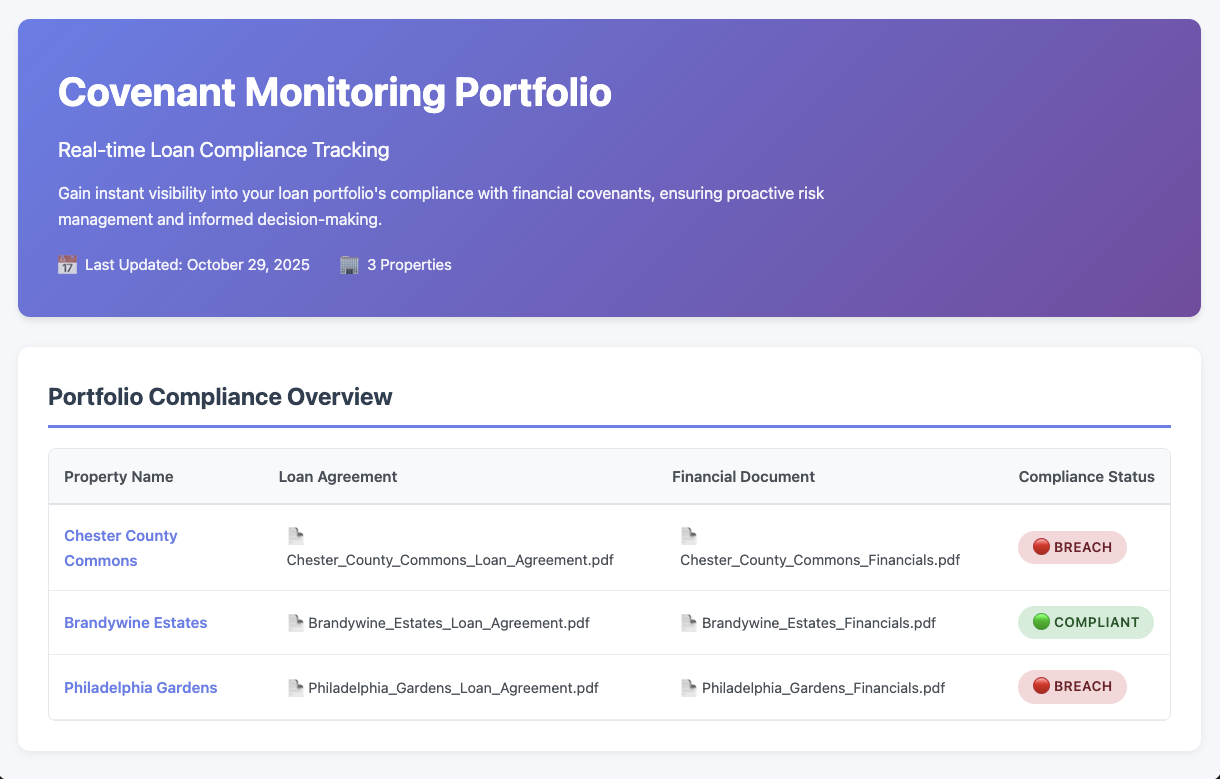

We developed an AI-powered covenant monitoring system that transforms how the client tracks financial compliance. The solution combines intelligent document analysis, automated data processing, and interactive dashboards, delivering continuous monitoring and immediate insights.

What We Built

- ● Smart document ingestion — Automated detection and pairing of "Loan Agreement" and "Financial Statement" PDFs in Google Drive

- ● AI text extraction — Extract NOI, debt service, and covenant thresholds directly from raw document text

- ● Automated DSCR analysis — Calculated DSCR, evaluated compliance, and tagged each property as Compliant, Warning, or Breach

- ● Dynamic dashboard generation — Compiled results into a JSON portfolio report and published an interactive HTML dashboard on GitHub Pages

- ● Instant alerts — Sent personalized email notifications with direct links to the live dashboard after each compliance cycle

Results

- ● 90% reduction in manual monitoring effort

- ● Real-time portfolio insights into DSCR and covenant health

- ● Zero data entry errors with AI-driven extraction and analysis

- ● Faster decisions through automated reporting and live dashboards

- ● A scalable, reusable framework for AI-powered financial oversight